News + Media

Amanda Giang models a pollutant’s pathways and assesses mitigation policies

His administration cherry-picked my group's findings to help make their case.

Joint Program co-directors to Wall St. Journal: Your editorial references our research to draw what we consider to be the exact wrong conclusion about the importance of the Paris Agreement to addressing climate change.

In a letter to The Wall Street Journal, Prof. Ron Prinn and John Reilly, co-directors of the Joint Program on the Science and Policy of Global Change, explain why their research shows the importance of the Paris climate agreement. “Paris provides an unprecedented framework for global cooperation on this serious threat. In our view, U.S. withdrawal from it is a grave mistake.”

Award-winning paper by Arun Singh shows how one of the world’s fastest-growing economies can expand its energy consumption while limiting emissions

A message to the MIT community from MIT President L. Rafael Reif

Additional Coverage: CNN (6:40 - 9:34), Politifact, Washington Post, Scientific American

Correcting the record on the US President's reference to MIT research

How the price of crude may shape the future of a low-carbon alternative

MIT Joint Program-affiliated Professor Susan Solomon (EAPS) co-authors study in Nature Scientific Reports

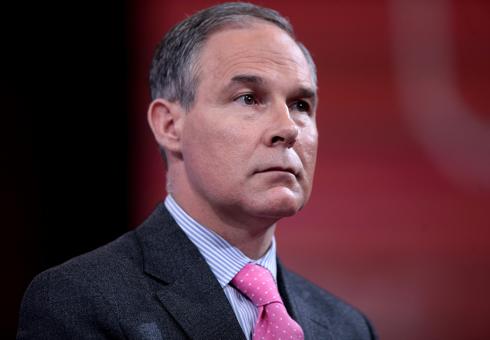

Researchers published a scientific paper that explicitly refutes an assertion by EPA Administrator Scott Pruitt on climate change. Related Links: Popular Science EnviroNews

Valerie Karplus, asst. prof. of global economics and management at the MIT Sloan School of Management and an MIT Joint Program researcher, comments in The Hill.